As traders and investors, our primary responsibility is to predict future asset prices without complete information. However, it is essential to remember that the future returns of any trading or investment strategy are randomly distributed. We must accept that we will always make errors in our judgments simply because we cannot predict the future with certainty.

Moreover, trading and investing are highly complex, as losing a trade does not necessarily mean we made a mistake. You can do everything right, follow your rules, and lose 12 trades. Therefore, making a mistake differs from losing money, and we need to track them separately from our profit and loss.

So, we need to ask ourselves: Are we trading poorly, or are we just experiencing an underperforming period for our system? We can become better traders and investors by keeping track of our mistakes and continuously improving our strategies.

I’d encourage you to take a look at Peter Brandt’s work on probability theory (it is behind his Factor Service paywall), but you can start here with an old tweet of his:

https://twitter.com/PeterLBrandt/status/1724982835478724771

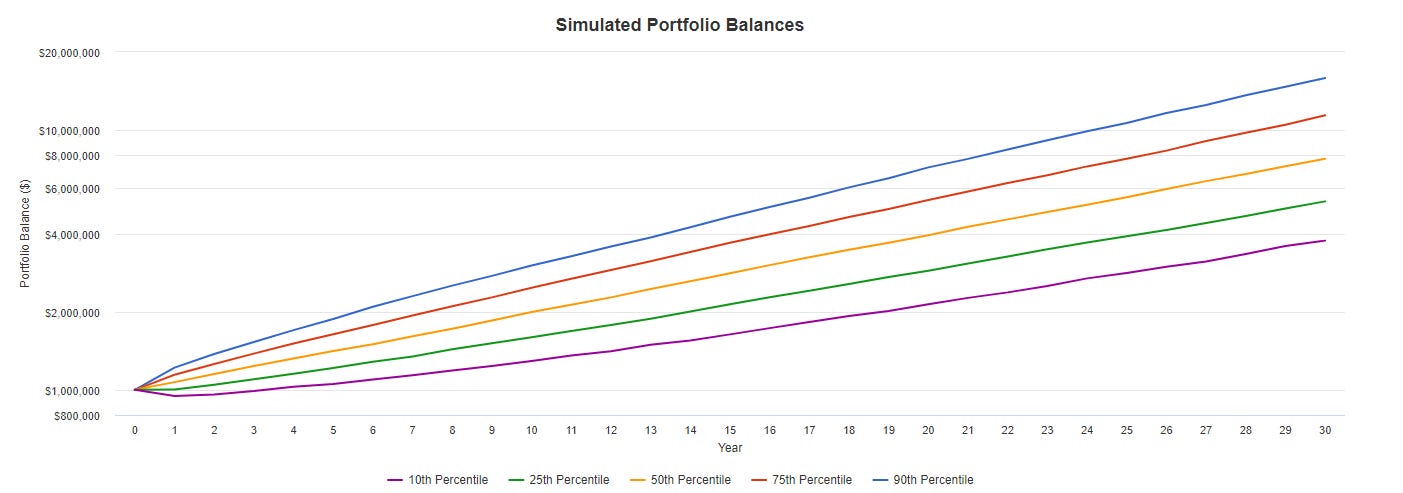

Now, we will show the randomness of returns with a simple annual rebalance model simulated for 30-year periods:

Please take a look at the potential return distributions carefully. There is a broad range of outcomes, and the difference in wealth accumulation can be substantial. Remember that even if you execute your strategy flawlessly, most of the performance is beyond your control. Additionally, look at the Monte Carlo Simulation of the Mythic Zoo Portfolio. The dark blue line represents the backtest results.

Clarifying if success is due to wit and skill or luck is key to confidence, but it's tough to be honest about your skills. Take a good hard look at your trading and be honest with your performance. Determine if you have an edge, and stick to that process! If you feel like you have been lucky, stop trading, research, and write up a trading plan.

I hope this is helpful to everyone. Happy trading!