Disclaimer: Mythic Market Research, Inc. is a proprietary trading company. Our posts are primarily for educational and entertainment purposes. Please note that they do not constitute financial advice.

Hey, I hope everyone had a great 4th of July! It was an eventful week, with stocks reaching all-time highs. The bull keeps dominating the bears whenever it can. Our portfolio has taken some hits from attempting some shorts but has also made some progress overall. The lack of pullbacks or shakeouts in these bull rallies is tough. Typically, sustained bull moves have 2- to 5-day shakeouts, but these rallies have been very tight and persistent and have yet to give us many opportunities.

As you can see from the chart below, May and June have provided fewer opportunities than the first four months of the year. Trade executions count both the opening and closing of a trade, so in June, we only had 13 trades compared to an average of 29.8 trades per month for the prior five months.

Remembering that we need to manage our expectations when assessing our performance, especially in a volatile market is vital. Without opportunities to trade, we can't reach our maximum potential. Therefore, it helps us put our performance into context. Understanding the potential outcomes of your strategy allows you to grasp the highest and lowest levels of performance monthly. However, we must be careful not to allow putting things into context to become an excuse for poor performance.

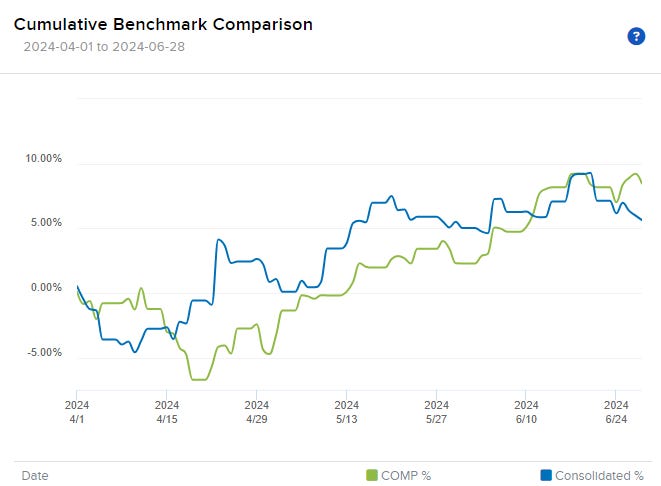

Consolidated Portfolio Performance Q2 2024: +5.65%

Consolidated Portfolio Performance June 2024: +0.58%

Wand OG Performance for June: +1.60%

Mythic Zoo Performance for June: -0.69%

Consolidated Portfolio Since Inception: +9.43%

Wand OG Portfolio Since Inception: 18.61%

Zoo Portfolio Since Inception: -2.97%

Final Thoughts

We have been dissatisfied with the Mythic Zoo portfolio's performance. While our long positions in Mythic Zoo have been profitable, the short positions have incurred significant losses due to current market conditions. The lack of market shakeouts has limited our opportunities on the long side to offset these short position losses. The equity market has been moving quickly, offering very few trading opportunities for us. As both portfolios are intraday, our next step is to establish a swing and position trading portfolio to partake in longer-lasting market moves. With each passing quarter, we gain more insights into our model's strengths and weaknesses. This will enable us to make improvements and develop strategies for better results. Overall, we are still satisfied with our trading performance and believe that we are just one strong quarter away from significantly boosting our portfolio performance.