Disclaimer: Mythic Market Research, Inc. is a proprietary trading company. Our posts are primarily for educational and entertainment purposes. Please note that they do not constitute financial advice.

Hey there! Thank you for subscribing and following us. I'm excited to write this month's portfolio review because the Wand OG Portfolio officially completed one full year of trading as of yesterday, July 31! This is a significant milestone for our team, and I am honored to share this moment with all our subscribers. We will highlight the Wand OG Portfolio's performance first.

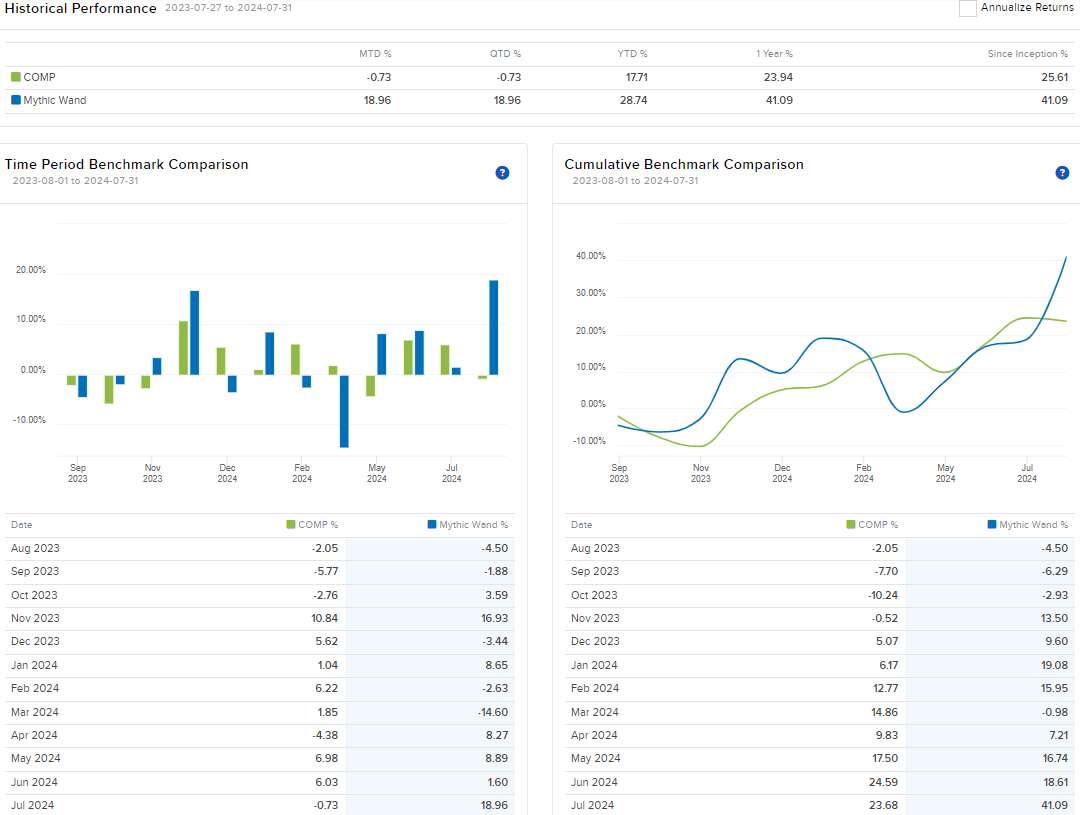

Wand OG Portfolio Since Inception: +41.09%

I want to share my thoughts on the Wand OG portfolio’s performance. I'm pleased with where we ended up, but the path to that result was frustrating. By the end of March, the program went from outperforming and being positive for the year to being in negative territory for the year. We were down 14.6% in March, with 15 losing trades in a row. We couldn’t secure a winning trade in March. The psychological toll was real, but we stuck to our models. We maintained discipline because we worked to understand the risk we were taking. We aim to maximize returns and keep drawdowns to less than 25% per portfolio. We also know that all of our returns in a rolling 12-month period will be produced by two, maybe three months. You can see from the distribution of daily returns that our returns have positively skewed characteristics, and those opportunities are rare. Regarding our performance, it's important to note that we achieved these results with a 6% correlation to the Nasdaq 100 Index, generating 32% of Alpha. Despite the frustration I experienced throughout the year while managing a portfolio of models, achieving a Sharpe Ratio of 1.11 and a Sortino Ratio of 2.40 is a significant accomplishment. Our partners will be visiting, and we'll be recording a special podcast episode in person!

In addition to hitting the one-year mark with Wand OG, our consolidated portfolio of Wand OG and Zoo had a great month.

Consolidated Portfolio Performance for July: +12.29%

Wand OG Performance for July: +18.96%

Mythic Zoo Performance for July: +3.52%

Consolidated Portfolio Since Inception: 22.88%

Zoo Portfolio Since Inception: 0.45%

Final Thoughts

In conclusion, while the journey to our final results was undoubtedly challenging, the Wand OG portfolio's performance demonstrates our strategy's resilience and effectiveness. The portfolio's low correlation to the broader market and its strong risk-adjusted returns highlight our ability to generate alpha. As we move forward, we remain committed to refining our models and maintaining our disciplined approach to risk management to deliver consistently exceptional performance for our partners.

Regarding our Zoo Portfolio, it feels like déjà vu compared to our experience eight months into managing the Wand OG portfolio. We are frustrated but remain hopeful about its ability to perform. It has the potential to produce significant monthly returns; we just haven't been in a situation where it can outperform.

It’s been amazing watching the improvements you’ve made. And of course sharing it all with us, that alone has made this project one of a kind for in my mind at least. Congratulations Gentlemen 🍾