Disclaimer: Mythic Market Research, Inc. is a proprietary trading company. Our posts are primarily for educational and entertainment purposes. Please note that our posts do not constitute financial advice.

Hey!

We want to thank all our new and old subscribers and followers. It has been a fantastic year, and it is great for us to share our journey with you. We are excited for 2025 and don’t plan to slow down.

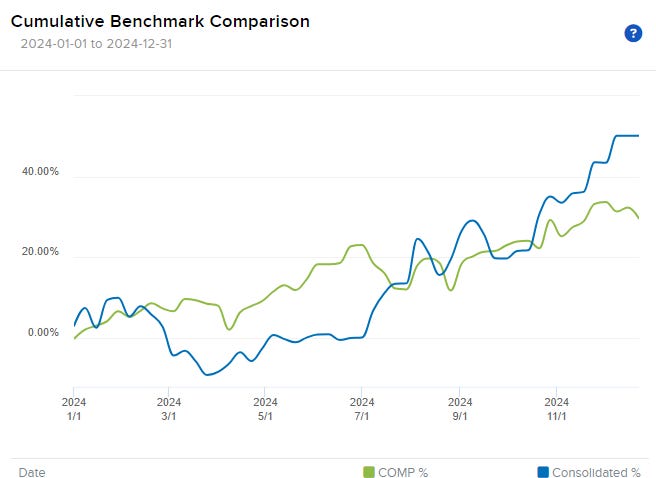

Consolidated Portfolio Performance for 2024: +50.12%

Wand OG Performance for 2024: +84.64%

Mythic Zoo Performance for 2024: +25.32%

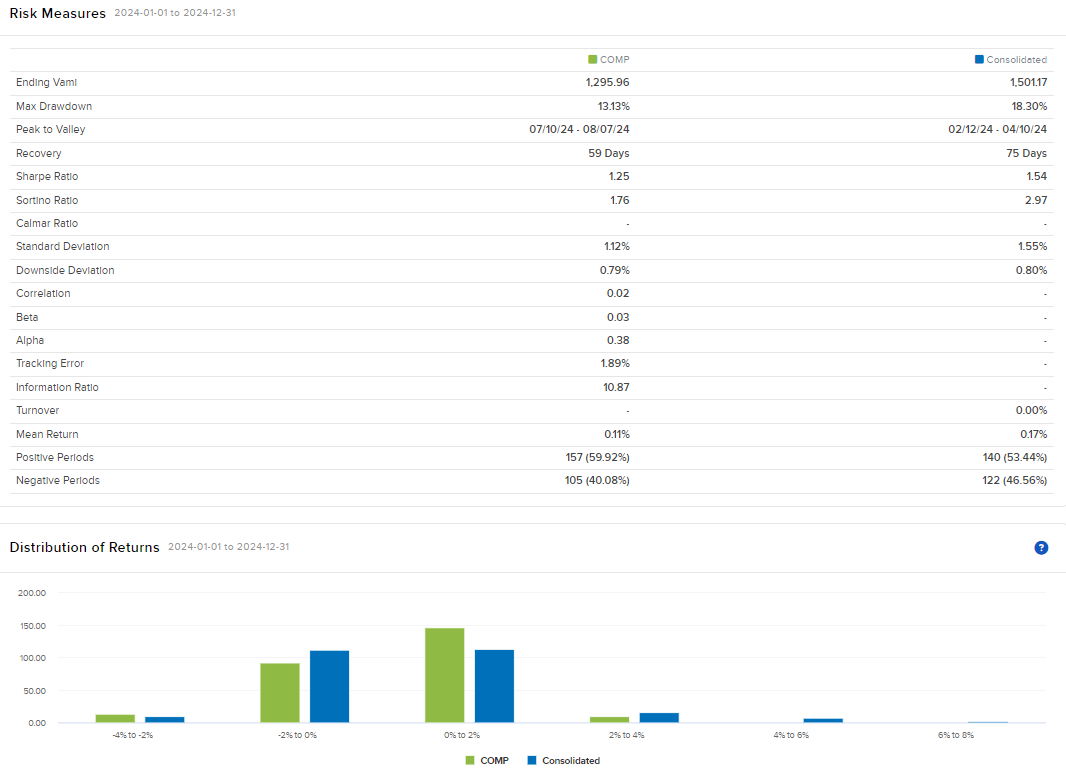

Daily Risk Ratio’s and Return Distribution

We prefer daily risk measures instead of monthly ones because we trade daily. This approach gives us more data points and allows us to assess the risk we take as a firm more accurately. While monthly measures are helpful in gaining a high-level understanding and analyzing risk over a 3 or 5-year period, they can introduce ambiguity when analyzing risk for just 1 year.

We want to highlight some of the key numbers we look at

Max Drawdown: -18.30%

We aim to maintain a less than 20% drawdown in any given year. While we aim for high returns, a drawdown exceeding 20% is psychologically taxing.

Sortino Ratio: 2.97

We view upside volatility in an equity curve as a positive. Therefore, we prefer to evaluate our performance on a risk-adjusted basis using the Sortino ratio instead of the Sharpe Ratio.

Correlation to Nasdaq 100: 2%

Alpha: 38%

Gain-to-Pain Ratio (Monthly Since Inception): 2.42

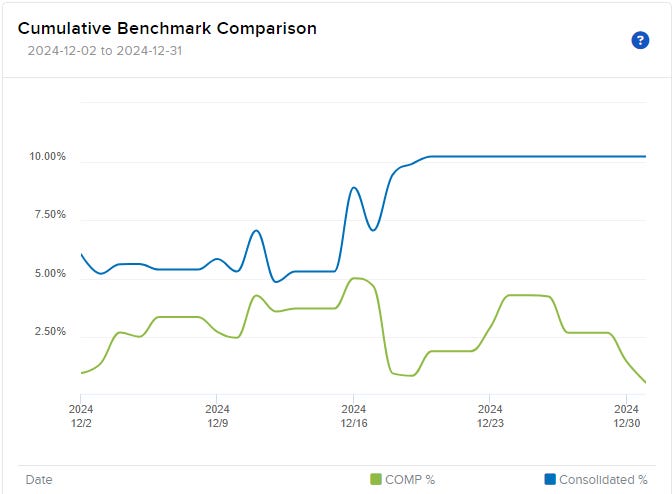

Consolidated Portfolio Performance for December: +10.22%

Wand OG Performance for December: +10.43%

Mythic Zoo Performance for December: +9.99%